Inverse Gold Etf Canada

This is the brand new claymore etf that allows you to effectively short the 10 year government of canada bond a bet that interest rates will go higher.

Inverse gold etf canada. The funds use futures contracts to gain exposure and essentially provide a synthetic short position in gold. Each inverse etf seeks a return that is 100 of the performance of its target. Market vectors gold miners etf. Inverse short gold etfs seek to provide the opposite daily or monthly return of gold prices.

The inverse gold etfs also called as short gold exchange traded funds allow for a low and cost effective manner to take a short position in gold and benefit from any potential price declines. These products provide inverse 1 1 exposure to the s p tsx 60 and s p500. This article lists the popular inverse gold etfs available for trading in the u s. This etf invests in gold mining companies throughout the world offering exposure to large cap companies in all corners of the world.

It is one of the most liquid gold etfs in canada with 1 41 billion in assets and has a net asset value of 22 63 per share. Horizons gold etf symbol. This etf s largest country weightings are in canada south africa and the u s with additional allocations to australia peru and the uk. In comparison the s p 500 is up 15 8.

Here are 5 of the most popular canadian gold etfs along with a brief overview of each. Hig horizons beta pros p tsx global gold inverse etf. Cib claymore inverse 10 year government bond etf. This single inverse etf gives you 1x the daily movement of the s p tsx global gold index.

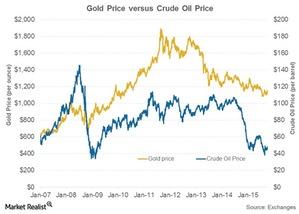

The price of gold has risen 39 0 over the past year and the vaneck vectors gold miners etf the gold mining company benchmark index has risen 60 1. The level of magnification is included in their descriptions and is generally 1x 2x or 3x. Similarly canadian investors can also bet against the american stock market through horizons betapro s p 500 inverse etf or bet on a leveraged etf that returns twice the negative return in any index. Each leveraged and inverse leveraged etf seeks a return before fees and expenses that is either up to or equal to either 200 or 200 of the performance of a specified underlying index commodity futures index or benchmark the target for a single day.

Since this is an etf focused on producers it has a much higher risk profile than gold bullion itself. Exchange traded funds etfs provide an easy way to invest in gold and canadians have several options for exposure to this precious metal.

.png.aspx)