Iron Condor Trading Service

Low volatility bull sideways chop or high.

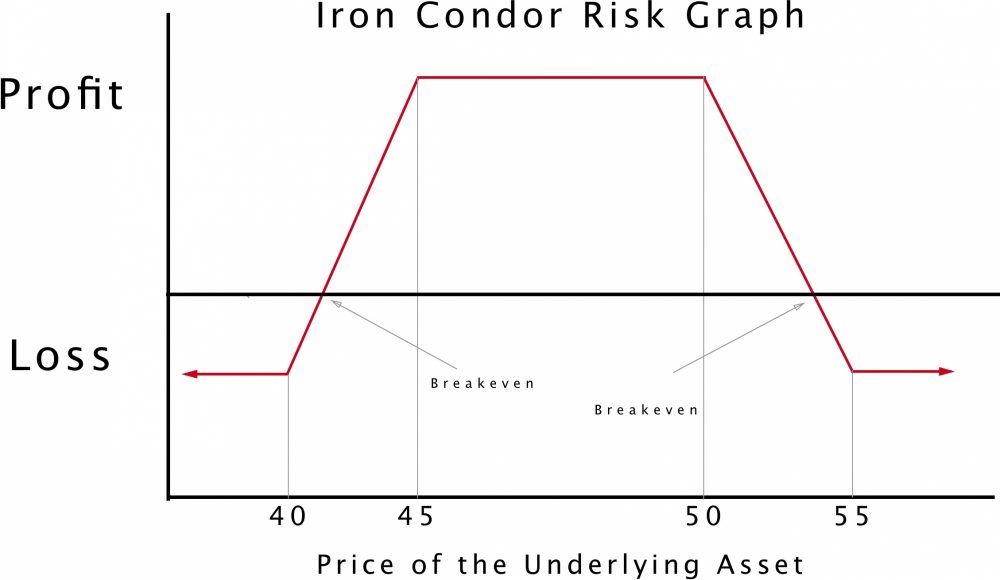

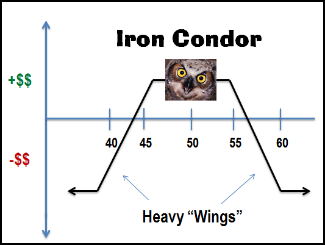

Iron condor trading service. We offer both a weekly plan and a monthly plan and a discount if you subscribe to both plans. Optionslinebacker is a defensively oriented iron condor service which helps you with all aspects of the iron condor. Weekly options iron condor trade is a type of options trade strategy that combines a put credit spread with a call credit spread. An iron condor is typically a neutral strategy and profits the most when the underlying asset doesn t move much.

The iron condor is our specialty and we show our students how to trade it through any kind of market. Specifically both credit spreads must. The ic1 service is an options advisory educational newsletter that focuses on non directional income generating option selling 9 to 13 trading days in duration 90 probability index credit spreads and iron condors using weekly options this service mostly avoids the monthly options 3rd friday expiration to minimize the risk associated with the options expiration and settlement process. Within the professional options trading community amy is known as a stable disciplined trader who calmly manages her risk throughout the life of the trade even in volatile market conditions.

The iron condor option trading strategy is designed to produce a consistent and small profit. Her bread and butter trades are the nested iron condor and the weirdor. Of an underlying asset. But even then the loss is capped to a certain amount.

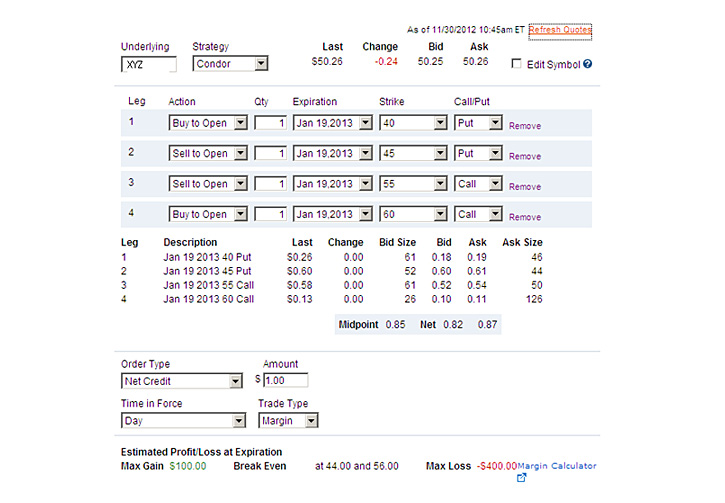

Welcome to condor profits service benefits. When we do iron condor trading we have to keep in mind that the potential loss is always bigger than the generated profit. An iron condor spread is constructed by selling one call spread and one put spread same expiration day on the same underlying instrument. Conclusion iron condor trading.

The iron condor is simply two option credit spreads one bull put spread and one bear call spread that meet the specific definition of an iron condor. Entering defending and exiting the trade and at all times practicing strong risk management while targeting conservative gains. Although the strategy can be constructed with a bullish or bearish bias. 1 have the same underlying stock etf or index 2 be the same expiration date and 3 the interval between the long and short strike price of each spread must be the same.

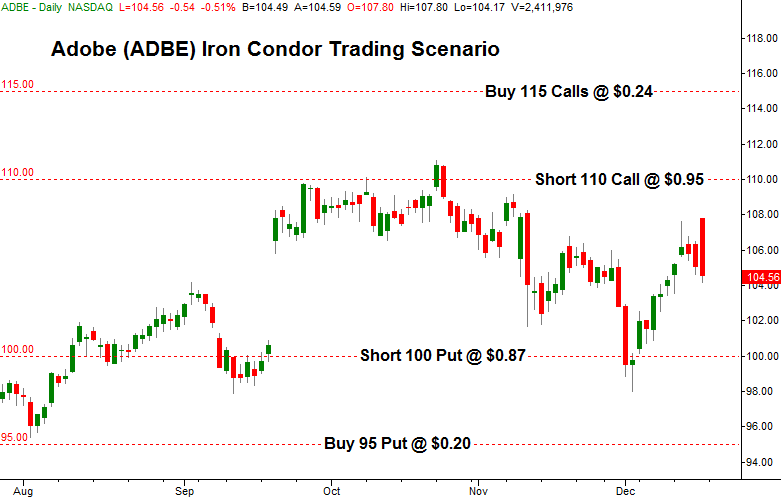

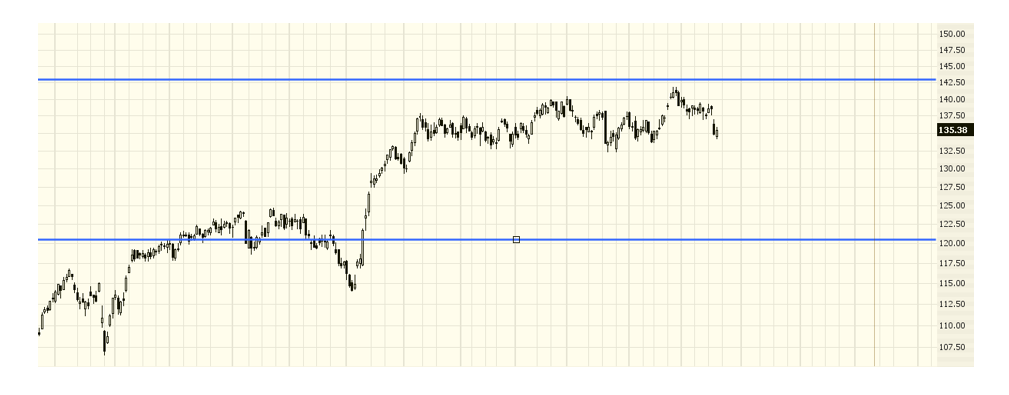

This is a popular strategy for monthly index options or with non trending stock as you don t want to enter iron condors on volatile stocks. A put vertical spread involves buying and selling of equal quantities of puts of same expiration but different strikes. All four options are typically out of the money. She is an active member of capital discussions and is a sought after webinar leader.

:max_bytes(150000):strip_icc()/OptionsTradingWithTheIronCondor-b4d19d75069b4dbe9b5b97d87124c7dc.png)

/IronCondor2-16a0be248c6949438b44ad617011a0f5.png)

/IronCondor2-16a0be248c6949438b44ad617011a0f5.png)