Irrevocable Living Trust California

Often the trust becomes an administrative trust until the.

Irrevocable living trust california. There are several types of irrevocable trusts but. California probate code 16060 protects the beneficiary rights in california on irrevocable trusts. When a california resident with a revocable living trust dies what was once a grantor trust taxable to the resident becomes an irrevocable trust with future income reported on a fiduciary return. The trustee can distribute income for the support of the beneficiary but an opportunity arises where the purchase of a condo would best serve the beneficiaries support needs.

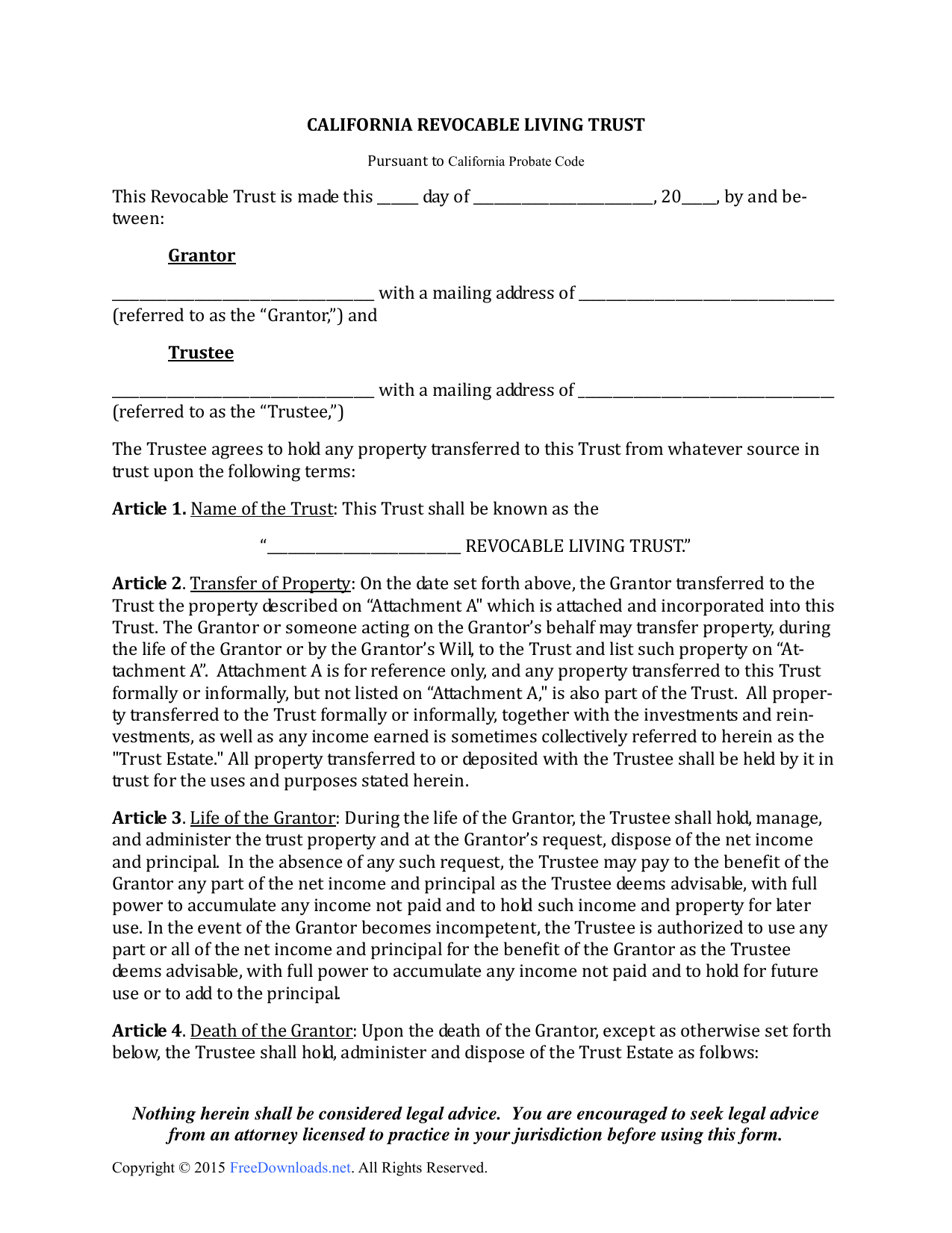

Fortunately california law allows for the amendment modification or termination of an otherwise irrevocable trust under the proper circumstances and using the proper procedures. How does a living trust protect assets. Can a living trust help save or reduce estate taxes. This sets them apart from revocable trusts which can be terminated at least until they become irrevocable at the death of the trust maker the grantor.

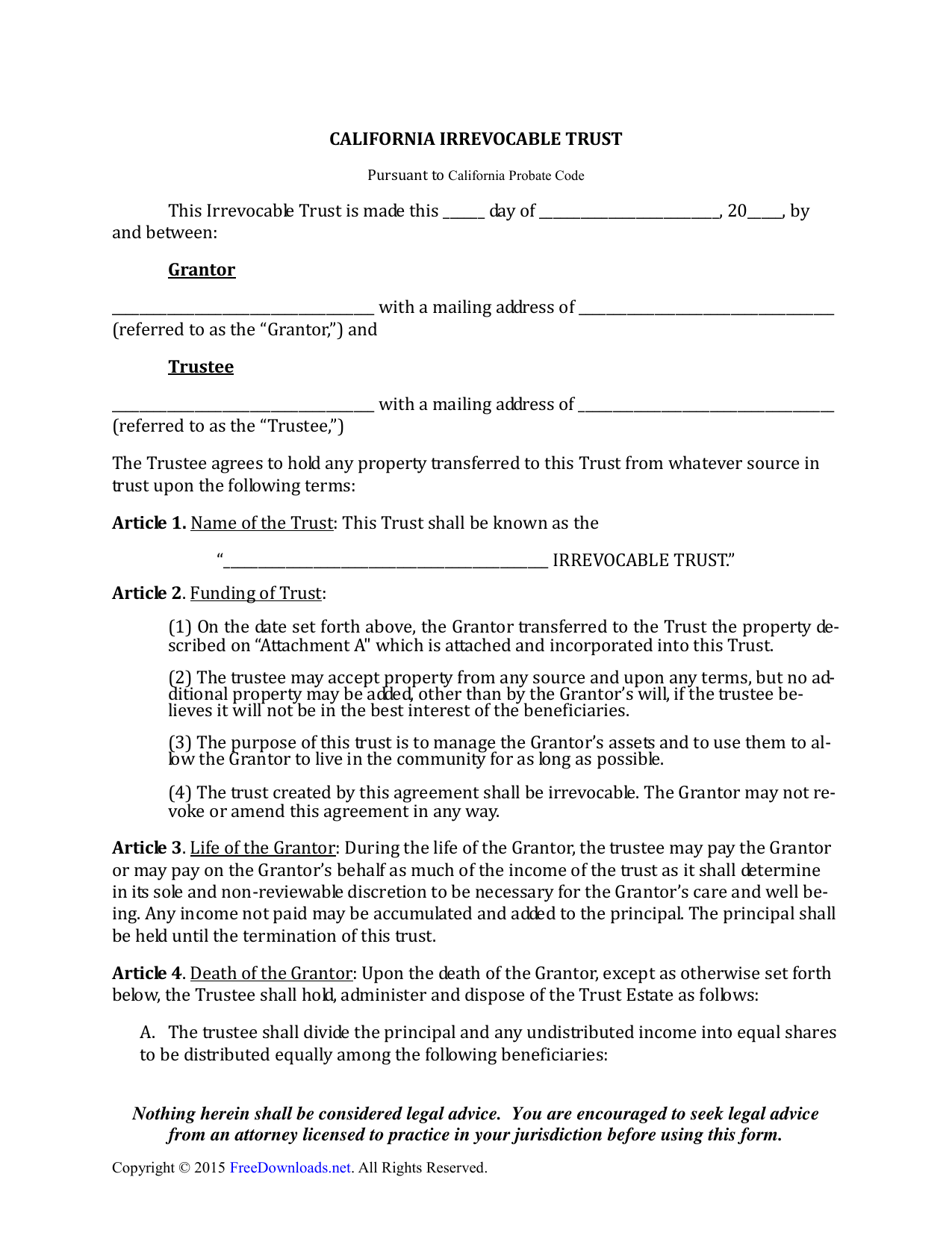

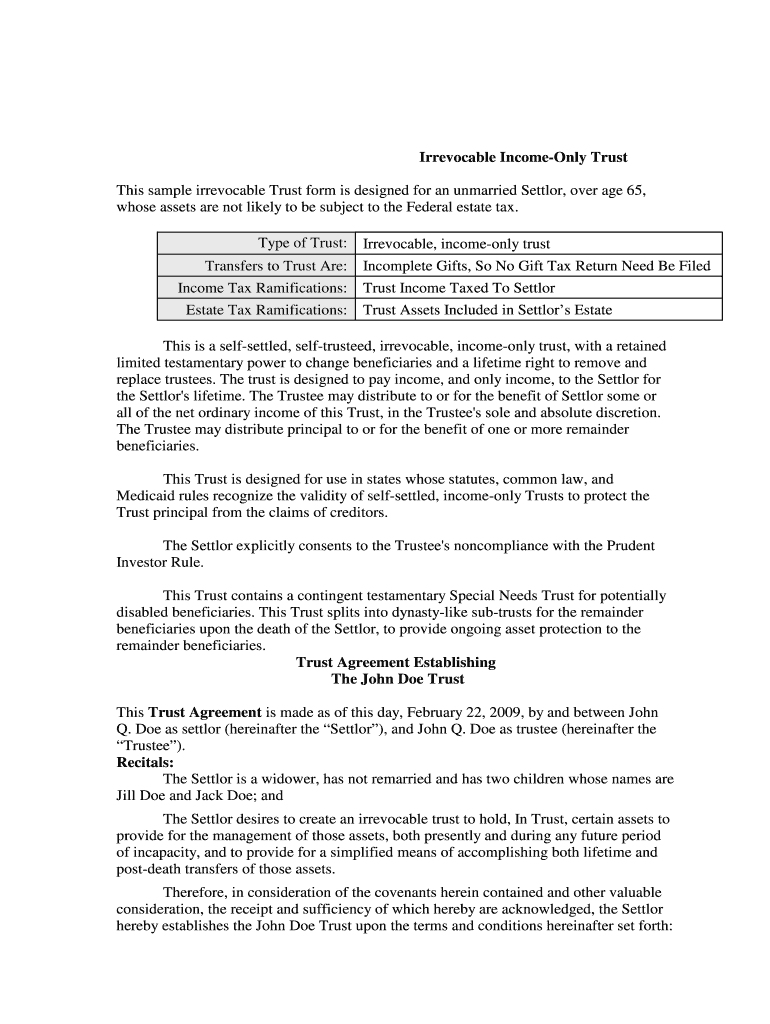

Irrevocable means the trust can t be changed or canceled this is often done for tax planning or to protect assets from creditors. Irrevocable trusts are designed for the long term management of assets. Tax benefits of irrevocable trust. Irrevocable trust beneficiary rights.

How to set up a living trust fund. It states the trustee has a duty to keep the beneficiaries reasonably informed of the status of the probate process and the beneficiary can enforce their rights by filing a probate court petition. Irrevocable trusts cannot be terminated after they are finalized. For example a california irrevocable trust is held for the benefit of a child until age 40.

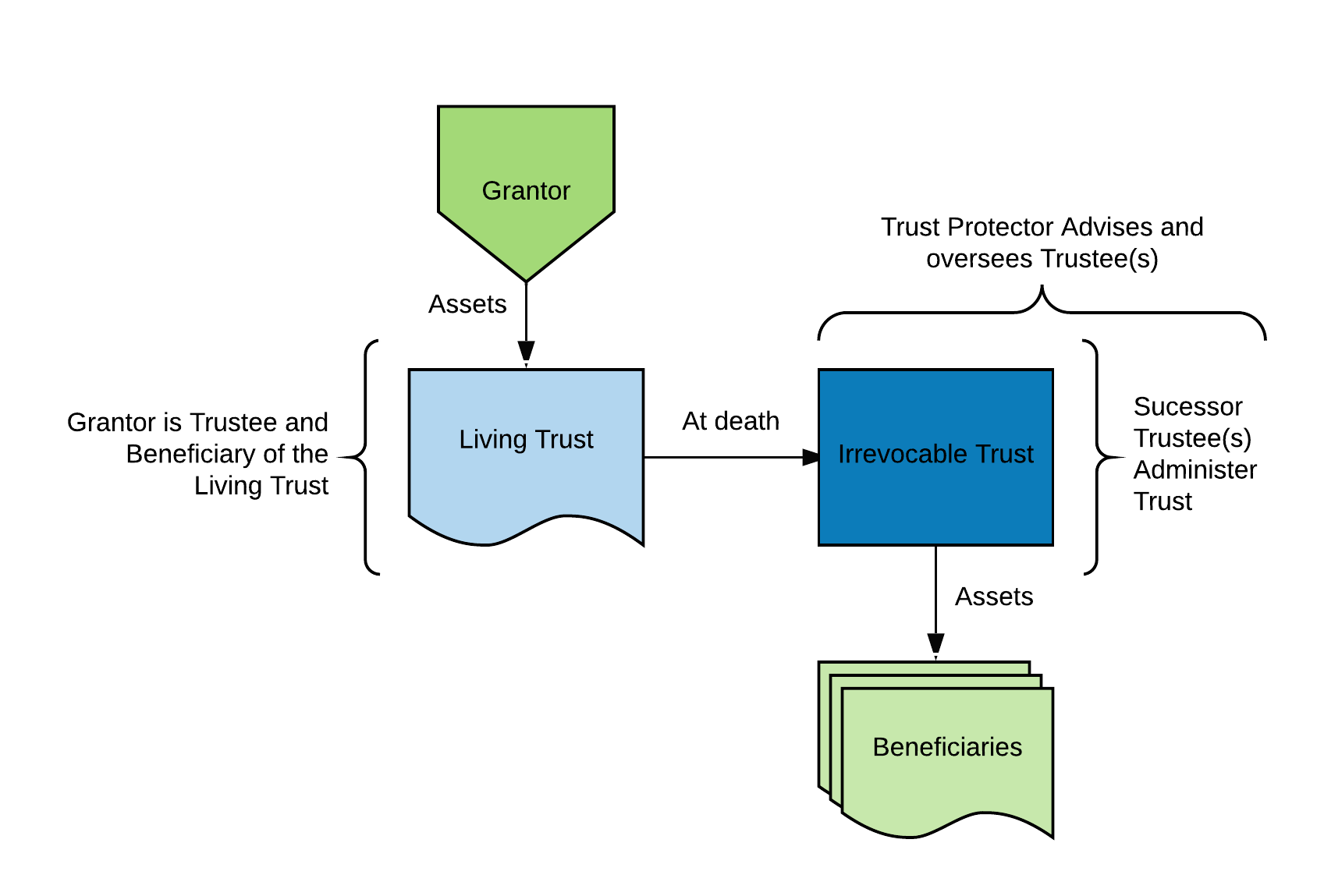

The state bar of california 180 howard street. An irrevocable trust is an estate planning tool designed for the long term management of assets which are permanently transferred into the trust. The income from the trust assets is either taxable to the trust or to the beneficiary. A california living trust is a document that enables an individual to manage their assets both during their lifetime and after death while avoiding the probate process the person establishing the trust the grantor can place their personal property and real estate within the trust so that it may be distributed directly to a beneficiary upon the grantor s death.

They are commonly used in estate planning. A california court will make the final determination on whether or not a revocable trust can be changed or revoked during divorce. To learn more about revocable trusts go here when talking about trusts the term living means that the trust goes into effect during the grantor s life.